FeeX is now Pontera

We’re deploying $80mm to help even more people reach a better retirement

A decade ago we embarked on a journey to tackle the asymmetry of information that existed in retirement plans. The new platform goes beyond providing enhanced visibility. It enables advisors to take action.

TLDR

- FeeX has changed its name to Pontera. “Pont” is Latin for bridge and we aspire to be The Bridge to a Better Retirement.

- Over the past 18 months, Pontera has raised three funding rounds totaling $80mm.

All three consecutive rounds were led by Lightspeed Venture Partners.

Additional participants included: The Founders Kitchen, Hanaco Ventures,

Hyperwise Ventures, Blumberg Capital, and other prominent investors. - As Pontera, we will continue our mission to help retirement savers retire with greater wealth and financial security by enabling their trusted financial advisors to manage their 401(k)s and other held away accounts in a secure and compliant way.

A decade long journey

A decade ago we embarked on a journey to tackle the asymmetry of information that existed in retirement plans. We knew that the different cost structures within participants’ accounts could have a dramatic impact on the amount of money they would have available for retirement.

We decided to found FeeX(ray), shortened to FeeX, as a way to empower retirement savers by helping them understand how their retirement accounts worked and what options they had available. We believed that more transparency would result in retirees saving more, earning more from their savings, and therefore achieving the best retirement possible.

Throughout the years, we were surprised to learn exactly how difficult it was to bring transparency to our clients’ retirement accounts. It felt like plunging down a deep, unnavigable rabbit hole: Hundreds of retirement account providers store their records in different formats. They utilize different names for similar investment vehicles (private funds, public funds, repackaged funds, collective investment trust, etc.). Offerings are often one-off and fund vehicles are customized to individual employers. Internal systems and transaction data are rarely consistent between providers. For a startup dedicated to making sense of it all, the challenge felt insurmountable.

As only 16 percent of private workers have access to a pension, the burden of financial stability in retirement has shifted to the American worker.1 With this in mind, and despite the aforementioned challenges, we persisted. At the core of our team is a strong belief that helping people retire comfortably is of critical importance.

As our technology improved and we moved closer to realizing our vision of having an accurate, fast, and secure way to understand retirement accounts, we started seeing demand from an unexpected industry participant: Financial Advisors.

Often we would receive calls from financial advisors who were going to great lengths to manage their clients’ 401(k)s and other held away accounts. Some elected to manually collect client statements and provide rebalancing instructions over email; others would walk their clients through changes to their portfolio in a shared Zoom session; and many stored their clients’ usernames and passwords to place trades on their behalf, triggering custody and subjecting themselves to SEC audits, all to provide full, comprehensive management of these assets for the benefit of their clients.

The most common theme across all advisors and clients we’ve spoken with is that they felt the experience could be better. While advisors had the best intentions, they were limited by the technology they had available. They were financial professionals, not software engineers or security experts. They could not hire a Chief Information Security Officer (CISO) or take the steps to receive a third-party SOC 2 certification like we had. As a result, many advisors were unnecessarily opening themselves up to cybersecurity risk. Many of them were storing usernames and passwords in plain text, excel files, or even post-it notes. They were also unable to track trading activities in an auditable trail, making SEC and custody audits costly and challenging.

We realized that there had to be a better way to allow advisors to provide the level of service their clients wanted without compromising on cybersecurity, while also providing them with a far more robust compliance and supervision infrastructure.

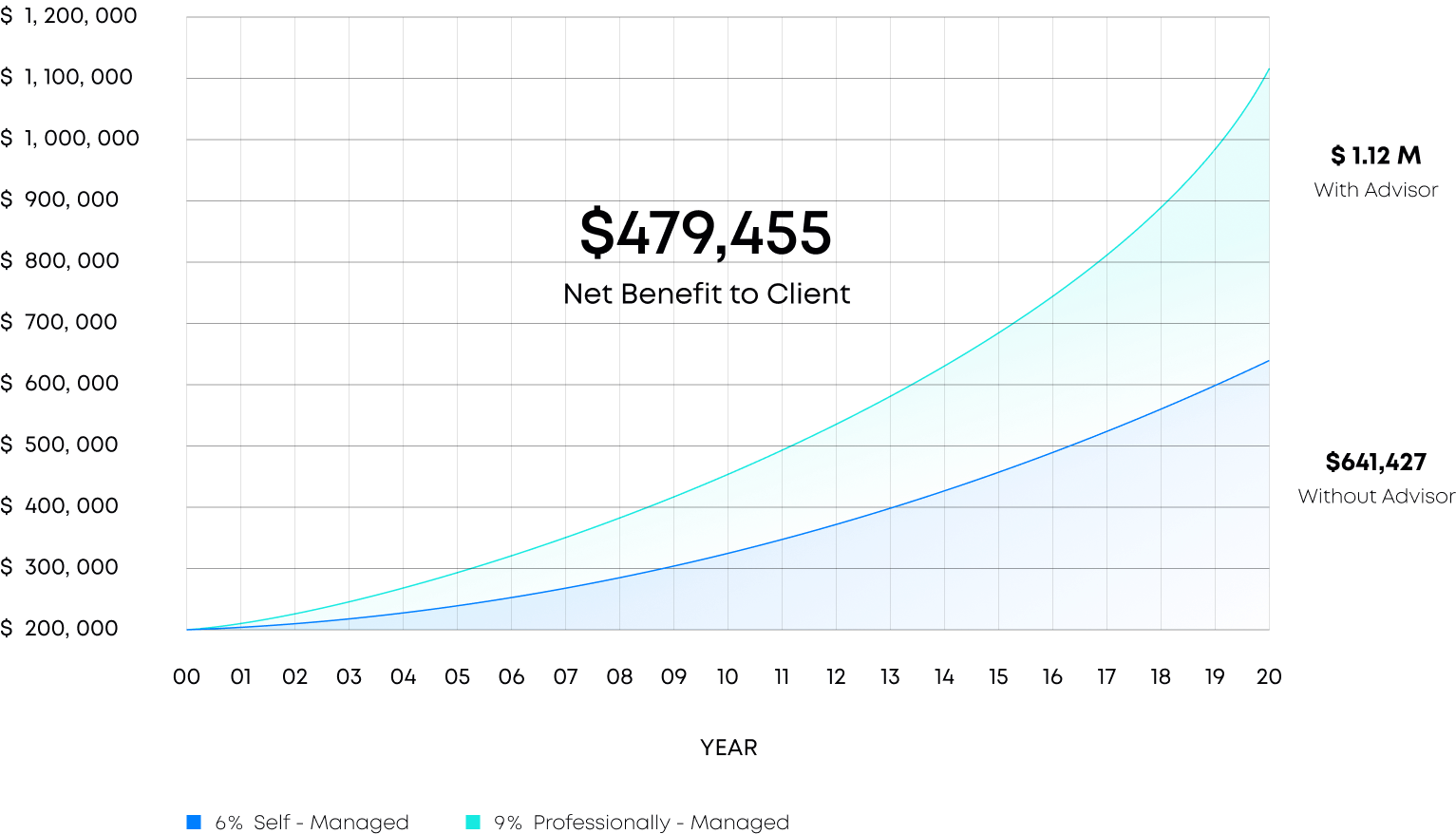

Financial advisors do more than merely educate their clients or place trades. When able to securely and compliantly manage held away accounts, advisors can help clients reap the benefits of truly holistic management across the entirety of their assets. Various studies have shown that professional management can provide between 3% and 4% in accretive annual returns, net of fees.2 Even at the lower end of that range, over 20 years of compounding returns, a 45-year old could see up to 75% more wealth at 65 by getting their advisor to help manage their retirement savings, as the chart below illustrates.

The benefit of professional management in qualified accounts

The benefit of professional management in qualified accounts

Professionally managed accounts outperform self-directed accounts by 3% annually, net of fees3

What better way to fulfill our vision of helping people retire with greater wealth than enabling their financial advisors to potentially add 3% or more in annual net returns while also improving their experience?

Pivoting from education to action

Four years ago, we upgraded our “transparency” engine. The new platform goes beyond providing enhanced visibility. It enables advisors to take action and securely manage held away accounts on their clients’ behalf. This allows advisors to improve the client experience and add value while mitigating the compliance and security concerns that surround managing these accounts.

These platform enhancements have allowed us to grow the scope of our mission. We aspire to be the bridge that connects advisors to their clients’ retirement needs, and as such, the bridge that helps millions of people reach a better retirement.

Once we determined that the better path forward was to support advisors by enabling them to manage their clients’ 401(k)s and other held away accounts, we sunset our consumer-facing FeeX(ray) product and became laser focused on delivering maximum value for advisors and their clients.

To further reflect our commitment to advisors and the clients they serve, today we are announcing that we have changed our name from FeeX to Pontera. “Pont” is Latin for bridge, and as Pontera we aspire to be The Bridge to a Better Retirement.

Today, Pontera is honored to serve thousands of financial advisors from all types of advisory practices, ranging from single person advisory firms to some of the world’s largest financial institutions. We serve both the RIA and Broker-Dealer communities.

To ensure advisors and their clients receive the best possible value, we have raised three rounds of funding totaling $80 million over the past 18 months. All three consecutive rounds were led by Lightspeed Venture Partners, who agree that helping advisors manage their clients’ 401(k)s and other held away accounts in a secure and compliant way is critically important.

In addition to Lightspeed, The Founders Kitchen, Hanaco Ventures, Hyperwise Ventures, Blumberg Capital, and other prominent individual investors also participated.

The new capital will allow us to continue to scale quickly. Our team today totals more than 100 employees and is growing rapidly. We are particularly proud of the fact that at least one-third of our team has been with us on this journey for more than six years. Each of us believes strongly in the mission of helping millions of people achieve the best retirement possible.